Have you ever had to decide how to spend money over an extended period of time? Perhaps you had to decide whether to buy or lease a vehicle, whether to finance a set of long-term projects, or whether to invest in specific capital projects. Whenever you have to make decisions about spending money over time, especially time periods that span many years, you want to make sure you’re accounting for the time value of money. If you don’t, you’re financial analyses may not reflect the “true” value of the alternatives and you could end up making an unwise investment decision.

Time Value of Money

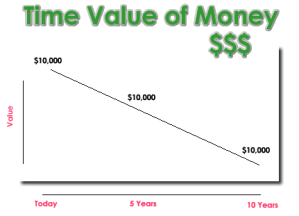

The time value of money refers to the concept that a dollar today is worth more than a dollar tomorrow. To see why this is so, think about the money in your bank account. Let’s say you have $1,000 in your account and you earn 3 percent interest annually. In this case, after one year the original one thousand dollars would be worth $1,030. So, assuming 3 percent annual interest, $1,000 today has the same value as $1,030 one year from now. In other words, if you expect to earn 3 percent annual interest, you should be indifferent between receiving $1,000 today and receiving $1,030 one year from now.

Investment Decisions

This concept is one reason why it’s important to discount future values when conducting financial analyses with data that span several years. Let’s say you’re trying to decide whether to invest in a project that will last five years. Because of the initial startup costs, which might include employee training and new equipment, it will cost you $50,000 to start the project. The project is expected to produce after-tax returns of $13,000 per year for the next five years. Given the risk of the project, the required rate of return is 10 percent. Given this information, should you invest in the project?

If you don’t consider the time value of money, your thinking might go something like: the project costs me $50,000 today, but over the next five years it generates a total return of $65,000 (i.e. $13,000 * 5). Since $65,000 is greater than $50,000, I should invest in the project.

Net Present Value

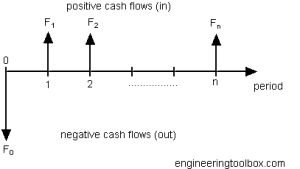

The problem with this reasoning is that it doesn’t take into account the time value of money. To do so, we need to discount the future returns by the discount rate and account for the time periods in which the returns are earned. By doing so, we will be calculating the net present value of the project. Net present value is a standard technique for incorporating the time value of money in a series of returns over time and is also used as a decision rule for investments. The decision rule is – if the net present value of the project is greater than zero, then it is appropriate to invest in the project.

In this example, the net present value of the project is about –$722*. Since the net present value of the project is less than zero you should not invest in the project. If you were to do so, you would lose money on the project. As you can see from this example, if you don’t account for the time value of money you can potentially make ill-advised investment decisions. To make proper investment decisions, be sure to account for the time value of money and calculate the net present value of projects. By doing so, you’ll be able to compare financial figures across time periods, i.e. compare apples to apples, and make knowledgeable investment decisions.

*NPV = –$50,000 + [$13,000/(1.1)^1] + [$13,000/(1.1)^2] +[$13,000/(1.1)^3] +[$13,000/(1.1)^4] +[$13,000/(1.1)^5]

NPV = –$50,000 + $11,818 + $10,743 + $9,767 + $8,879 + $8,071

NPV = –$50,000 + $49,278

NPV = –$722